Let's Talk

Free Consultation

If you ever need a salary certificate, it’s important to know how to go about getting it from your employer and what you need to do if you need to get it attested. While the salary certificate format in UAE is not the same in every company, certain pieces of information are common across every certificate. Without it, the certificate would not be valid.

Everything You Need to Know About a Salary Certificate

Key Differences Between Salary Certificate and Salary Slip

Salary Certificate | Salary Slip |

Acts as proof of employment | Acts as proof of payment by employer |

Only issued upon request | Generally issued every month |

Used for visa applications, lease agreements, mortgages, loans, credit cards | Used for multiple situations |

Contains detailed information about designation, period of employment, gross & net salary | Contains detailed information about salary (including benefits and deductions) |

Importance of Salary Certificate in UAE

You can ask for a salary certificate in UAE for the following reasons:

- For finalizing rental agreements: A salary certificate confirms your employment to your landlord and that you can pay your rent on time.

- For bank loans: It acts as a guarantee to lenders that you are financially stable enough to repay your loan.

- For tax: It shows foreign tax authorities proof of your income.

- For credit card applications: It confirms your creditworthiness to banking institutions.

- For visa renewals or applications: It proves your income source to foreign authorities and confirms that you will be coming back to your country.

- For government services: You may need a salary certificate for certain clearance procedures, or registering utilities.

- For family court: It can be used as evidence that you are financially able to support your dependent or pay alimony.

Essential Details in a Salary Certificate

The salary certificate format in UAE will vary across companies. However, these are some of the key details you can find in a typical salary certificate:

- Employee information (name, job title, employee ID)

- Employer information (company name, address, company letterhead)

- Job details (start date, type of contract)

- Salary details (basic salary, allowances, deductions)

- Total earnings (gross salary, net salary)

- Purpose of certificate issuance

- Date of issuance

- Authorized signatory details and company stamp/seal

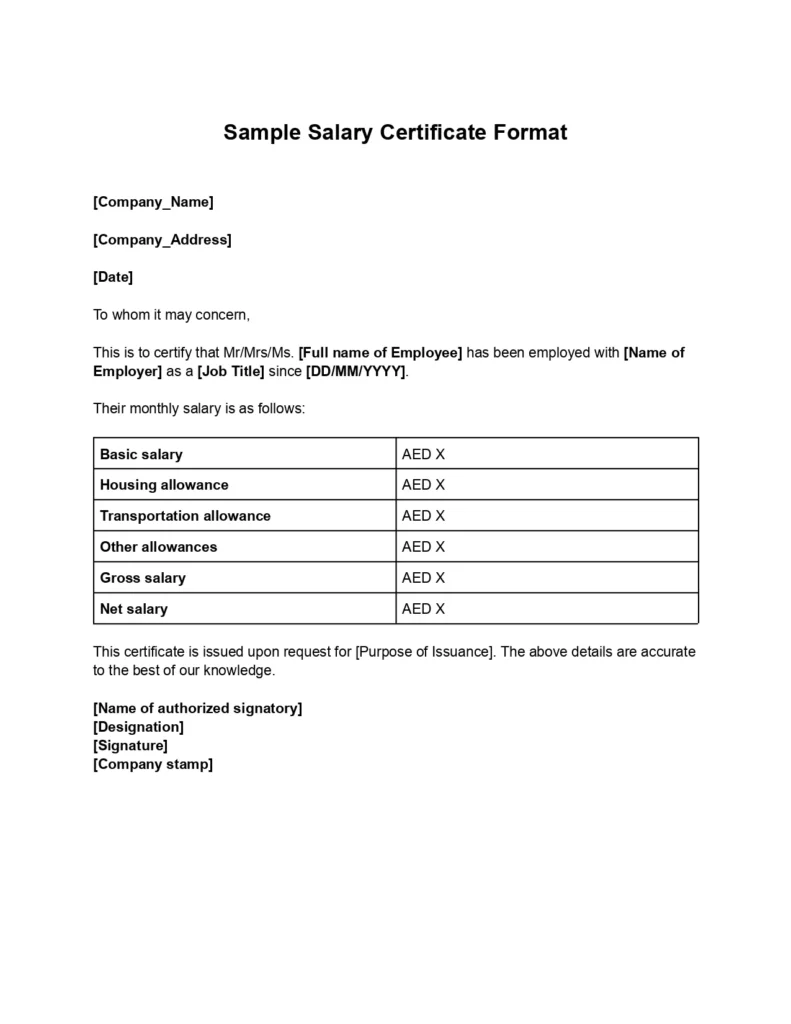

Salary Certificate Format Sample

[Company_Name]

[Company_Address]

[Date]

To whom it may concern,

This is to certify that Mr/Mrs/Ms. [Full name of Employee] has been employed with [Name of Employer] as a [Job Title] since [DD/MM/YYYY].

Their monthly salary is as follows:

Basic salary | AED X |

Housing allowance | AED X |

Transportation allowance | AED X |

Other allowances | AED X |

Gross salary | AED X |

This certificate is issued upon request for [Purpose of Issuance]. The above details are accurate to the best of our knowledge.

[Name of authorized signatory]

[Designation]

[Signature]

[Company stamp]

We’ve attached both PDF and Word versions of the standard Salary Certificate format for your convenience. This template is frequently requested by employees—both within and outside our organization—and can be used as an official reference. Feel free to download and customize it as needed for your salary verification requirements.

How to Get a Salary Certificate in UAE

1. Reach Out to Your HR Department

The HR department at your workplace will issue your salary certificate in UAE. Reaching out to them is the first step.

2. Provide Necessary Details

You will need to give them the reason for your request and the name of the institution or entity the certificate will be addressed to. Make sure you provide all the details they need to issue the salary certificate so you can avoid any delays.

3. Follow Up If Needed

You can follow up on your salary certificate request if it takes longer than 3-5 business days for HR to issue the certificate.

Salary Certificate Attestation

You will need to attest your salary certificate if you’re using it outside the country, like visa applications or foreign tax obligations. Attestation simply confirms the authenticity of a document and its contents.

The Ministry of Foreign Affairs (MOFA) is the government body that will attest your salary certificate in UAE. There might be some extra steps involved before you send your certificate to MOFA depending on your income level:

- If you make under AED 10,000, you will need to get an affidavit from IVS Global and may need to submit extra documents like bank statements and your employment contract. It costs AED 30 for the affidavit, around AED 50 to get it delivered, and AED 54 if you want to get it attested by IVS.

- If you make over AED 10,000, you will need to get a stamp from the Chamber of Commerce along with the affidavit. This is available to you free of charge.

How to Get Your Salary Certificate Attested in UAE

1. Get Your Salary Certificate from Employer

2. Complete Pre-Attestation Process

3. Register on MOFA Website or App

4. Submit Document and Choose Delivery Method

Choose the “Attestation of Official Documents, Certificates”, highlight that your document is a salary certificate, and enter the place of issue. Make sure to include the pre-attestation documents and stamp.

You can have your certificate delivered to you if you need a physical copy, or you can choose to receive it as a digital certificate. You can also arrange to pick it up yourself from the nearest Customer Happiness Center.

5. Pay Attestation Fees

Is Your Salary Certificate Valid Outside the UAE?

Know Your Rights as an Employee

As an employee, it is important that you know your rights when it comes to getting a salary certificate in UAE:

- You are allowed to request a salary certificate at any time, for any reason

- Employers are legally required to provide a complete, accurate certificate

If you receive an unusable document, or your employer refuses to provide you a certificate, you can file a complaint with MOHRE (Ministry of Human Resources and Emiritisation).

Common Mistakes to Avoid When Getting a Salary Certificate

To avoid delays in getting your salary certificate in UAE attested, use the following checklist:

- Check that your name, job, title, and salary are accurate

- Ensure that the purpose of your certificate request is mentioned

- Make sure the company’s letterhead, stamp, and signature are present

- Ensure that the pre-attestation stamp is visible

The salary certificate format in UAE is not standardised, but its key details are essential knowledge for every employee. Without understanding what goes into the certificate, you may miss out on certain information and run into problems down the line. As a salary certificate has many uses across the UAE (government services, tourist visa application, credit card), highlighting the purpose of its issuance to your employer is important. Knowing how to attest salary certificate in the UAE can speed up the process and help avoid any delays.

Frequently Asked Questions

How Do I Ask for a Salary Certificate?

Is Salary Certificate and Pay Slip the Same?

How Long is a Salary Certificate in UAE Valid?

What is the Salary Certificate Format in UAE?

How Many Days Does It Take to Get a Salary Certificate in UAE?

Do I Need to Attest My Salary Certificate?

How Much Does Salary Certificate Attestation Cost?

Can I Get a Salary Certificate Online in UAE?

What Do I Do if My Company Doesn’t Give Me a Salary Certificate?

As an employee, you have the right to make a request for a salary certificate for any reason without facing any discrimination. If your employer declines to issue a the salary certificate, you can lodge an official complaint with MOHRE.