Business Setup inRAKEZ Free Zone

Home / Business Setup with Rakez Free Zone

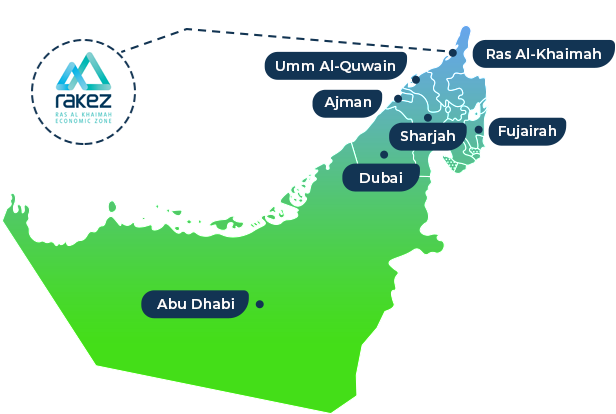

Ras Al Khaimah Economic Zone

(RAKEZ Free Zone)

RAKEZ Free Zone or Ras Al Khaimah Economic Zone was the initiative guided by the vision of His Highness Sheikh Saud bin Saqr Al Qasimi, Ruler of Ras Al Khaimah and United Arab Emirates Supreme Council Member. RAKEZ was established with the motive to oversee and consolidate specialized zones and clients of both RAK Investment Authority (RAKIA) and Ras Al Khaimah Free Trade Zone (RAK FTZ). We are experts when it comes to RAK Free Zone company setup and can be counted on to lend our professional expertise to all matters involving company formation.

Business setup in Ras Al Khaimah Economic zone is a great achievement because it’s estimated to be one of the largest economic zones in the region. The zone covers around 33 million square meters of land and comprise of more than 13,000 companies. RAKEZ business zone is currently served by RAKIA and RAK FTZ from more than 100 countries and represent over 50 business sectors. Business setup in Ras Al Khaimah Economic zone is the continuation of RAKIA which established in 2005 and RAK FTZ established in 2000.

Freezone Locations

Features of RAKEZ Free Zone

- RAK free zone company setup offers 100% ownership

- Entity formation as free zone and non-free zone

- Quick and efficient business setup processes

- Ability to build on-site staff and accomodation

- Wide-range of businesses, industrial facilities, and value-added services

- One-stop solution for all services

- Customer portal with self-service

- Strong connectivity to major logistical hubs and multilane super highways

- Business setup in Ras Al Khaimah offer easy accessibility via an international spread of regional offices

- Get easy access to markets across the countries like Middle East, Asia, North Africa, and Europe regions.

RAKEZ is Divided into Specialized Zones

- RAKEZ Business Zone,

- Al Hamra Industrial Zone,

- Al Ghail Industrial Zone,

- Al Hulaila Industrial Zone

- RAKEZ Academic Zone

The above zones cater various sectors that include trading, services, consultancy, manufacturing, industrial projects, logistics, schools, universities, institutes, academic consultancy and other services.

Al Hamara

industrial zone

Al Hamara is a suitable space for both light industries and heavy industry projects. It allows both free zone and non-free zone entities.

Al Ghail

Industrial zone

Al Ghail is a perfect choice for large-scale industrial manufacturing enterprises. It’s a preferable choice for free zone and non-free zone entities.

Al Hulaila

Industrial zone

Al Hulaila is a home for heavier side of industrial manufacturing.

Structuring of Business Operations in the Free Zones and Non- Free Zones

The business operations of a company registered in RAKEZ free zone can be structured in either one of the following ways:

- Branch of a foreign company or locally registered entities;

- As a Free Zone Establishment (FZE), wherein there is only one shareholder

- As a Free Zone Limited Liability Company (FZ-LLC), wherein there are 2 – 5 shareholders

Business Structure Options in RAKEZ Non-Free Zone

- INDIVIDUAL ESTABLISHMENT: Sole owner

- LIMITED LIABILITY COMPANY (LLC): 2 or more shareholders (upto 50 shareholders)

A non-free zone operation requires a UAE national partner.

In case of a Free Zone Establishment (FZE) and Free Zone Limited Liability Company (FZ-LLC) the minimum capital requirement is AED 100,000). However, it is not mandatory to evidence the deposit of the capital amount.

If it’s a non-free zone company, it will have sufficient capital to achieve the purpose of incorporation and the capital has equal shares in value. In case of a proposal made by the minister in combination with the competent authorities, cabinet may issue decision that determines the minimum capital of the company.

Business Setup in RAKEZ Free Zone

Business setup in RAKEZ Free Zone offers unparalleled advantages for entrepreneurs and companies looking to establish themselves in the UAE. Established in 2017 through the consolidation of the RAK Free Trade Zone (RAK FTZ) and the RAK Investment Authority (RAKIA), the Ras Al Khaimah Economic Zone (RAKEZ) stands as a leading facilitator for business establishment and growth in the United Arab Emirates (UAE). This strategic merger streamlined company registration processes and expanded the available industry scope, presenting a wealth of opportunities for ambitious investors.

With the UAE’s corporate outlook predicting continued economic growth in the next few years, RAKEZ provides an ideal opportunity to capitalize on this potential. Its vast spectrum of firm structures and specialized zones meet a wide range of needs, from thriving commercial activity in the RAKEZ Business Zone to concentrated industrial expertise in Al Hamra, Al Ghail, and Al Hulaila. Even academic institutions can thrive in the RAKEZ Academic Zone. While geopolitical and global economic swings provide some hurdles, RAKEZ’s strong infrastructure and tax-free environment provide a secure and beneficial foundation for corporate growth. Businesses setup in UAE can leverage RAKEZ’s strategic location and investor-friendly policies to establish a strong presence in the region. Let us therefore delve deeply into comprehending the RAKEZ Free Zone in the UAE.

Benefits of Establishing a Business in RAKEZ

Business setup in RAKEZ gives many benefits, creating a fertile ground for your venture to flourish. Here are some key advantages:

Tax Haven

RAKEZ operates under a zero-tax regime, exempting companies from corporate and personal income taxes. As a result, this translates to significant cost savings and higher profit margins.

Unrestricted Ownership

Enjoy complete control over your business with 100% foreign ownership permitted. Additionally, you benefit from full profit repatriation, ensuring unhindered capital flow.

Trade Facilitation

Streamline your import and export operations with complete exemption from import and export duties within the free zone. This fosters efficient international trade and reduces overall costs.

Cost-Effectiveness

Compared to other free zones, RAKEZ offers competitive operational costs, including flexible setup packages and business-friendly regulations. Moreover, this makes it an attractive option for budget-conscious

businesses.

Transparency and Flexibility

RAKEZ’s legal framework is known for its clarity and adaptability. This allows for a smooth business setup process and facilitates quick decision-making.

Procedures for Business Setup in RAKEZ

Choosing the Right Business

At A&A, we understand that selecting the appropriate business is crucial for growth. RAKEZ offers a diverse range of business licenses and facilities tailored to various industries. Therefore, it becomes essential to align the chosen business with the available licenses and facilities to ensure compliance with regulatory requirements and operational needs.

Submission of Application and Documents

- Document Requirements: Applicants need to submit a comprehensive set of documents. These documents typically include:

- Completed applications

- Passport copies

- Visa copies

- Educational and experience certificates (if applicable)

- A detailed business plan outlining operations and financial projections.

Receiving Your Business License

Upon successful submission and review of documents, the final step involves obtaining the business license. This license grants legal permission to operate within RAKEZ. However, it is important to note that the license type varies based on the nature of the business.

Why Us?

Customised Solutions

Experienced Consultants

Hassle-Free Procedure